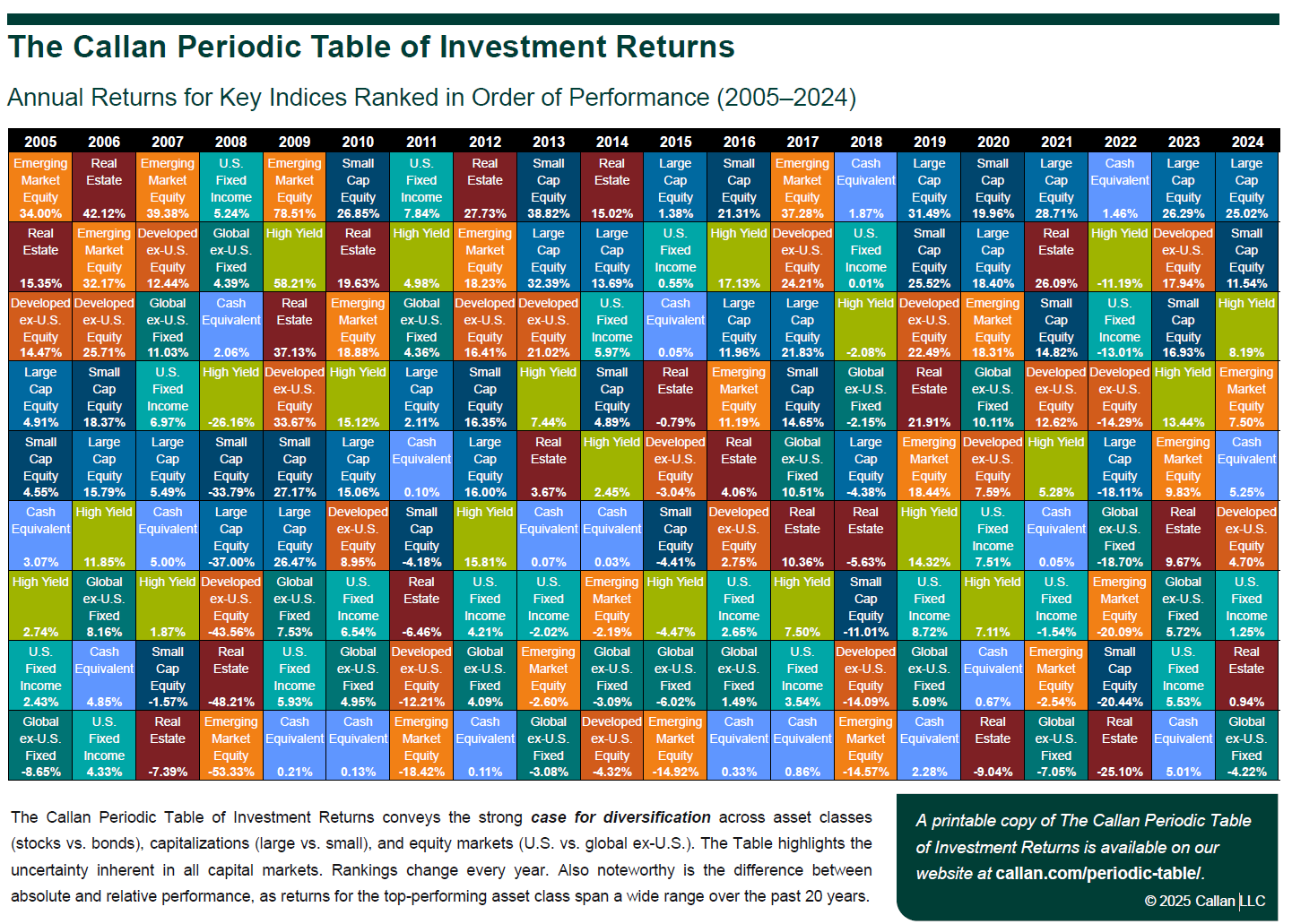

Please find the Callan Periodic Table of Investment Returns, issued by Callan LLC, for the past 20 years, ending in December 2024. This table visually represents the returns from most public asset classes available to investors, and many are represented in Callan Family Office client portfolios. The returns are ranked annually from best (top of table) to worst (bottom). Last year’s returns continued the strong performance from 2023, with positive results across most asset classes. Equities were the best performer fueled by a still robust U.S. economy.

A few observations worth noting:

- In 2024, 90% of the listed asset classes generated a positive return, with only international bonds generating a negative return.

- U.S. equities, both large and small cap, remained at the top of the chart in 2024, continuing a trend of outperformance. Over the past 10 years, U.S. stocks continue to significantly outperform all other asset classes represented in this chart. The S&P 500 has now delivered +20% returns two years in a row, which has happened nine times (including 2023 and 2024) since 1950. In six of those prior eight times, the return in the subsequent third year was also positive.

- In the U.S. markets, both value stocks and growth stocks enjoyed strong returns with tech-heavy growth stocks being the stronger performer. Their returns were driven in large part by the concentration in the index of the Mag 7 stocks, which continue to benefit from artificial intelligence (AI) tailwinds.

- International and emerging market stocks also recorded modestly positive returns. Global unrest, political challenges, and currency movements continue to weigh on these markets.

- Fixed income returns in the U.S. were slightly positive. It is interesting to note that the 10-year Treasury yield started the year at 3.8% and ended at 4.6%, while the Federal Reserve cut the Federal Funds rate by 100 basis points in the fourth quarter of 2024.

A key overarching observation is that that no one asset class outperforms in every environment. It also highlights the importance of diversification, a pillar of our investment strategy.

If you would like to discuss these asset class returns further, please reach out to your Callan Family Office team for additional information.

To download a PDF of the Callan LLC Periodic Table, please click here.

Callan Family Office (“CFO”) is providing the information from Callan LLC (“Callan”) for information purposes only. CFO is not involved in drafting or reviewing the content. Although we believe Callan and its content to be reliable, we make no representations as to their accuracy or completeness.

Callan Family Office (CFO) is the exclusive trademark licensee of Callan LLC. Callan LLC provides products and services to CFO. Clients of CFO are not clients of Callan LLC, and the parties are not affiliated. Callan LLC, CFO and the other Callan trademarks and service marks are registered and/or unregistered trademarks of Callan LLC and may not be used without its permission.

INVESTMENT ADVISORY SERVICES AND PRODUCTS PROVIDED TO CLIENTS OF CFO ARE PROVIDED SOLELY BY CFO AND NOT BY OR ON BEHALF OF CALLAN LLC. REPRESENTATIVES OF CFO ARE EMPLOYEES AND AGENTS OF CFO AND NOT EMPLOYEES OR AGENTS OF CALLAN LLC.