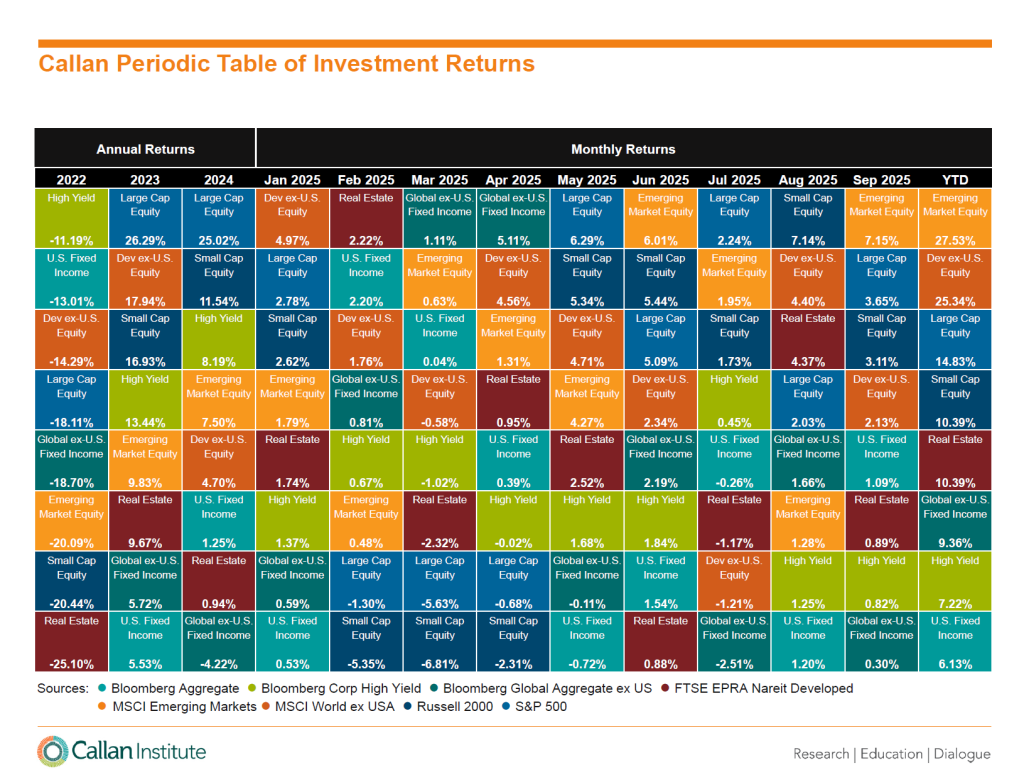

Please find attached the Callan Periodic Table of Investment Returns for the past three years ending December 2024 and year to date as of September 2025. This table visually represents the returns from most public asset classes available to investors with many represented in Callan Family Office client portfolios. The returns are ranked annually from best (top of table) to worst (bottom).

The markets rose again in the third quarter and performance was positive across all asset classes. Equities were the best performer supported by a robust and resilient U.S. economy, along with positive global macro conditions.

A few observations worth noting:

- International equities are significantly ahead of U.S. stocks year-to-date (YTD) as international stocks have benefited from a weaker dollar. Emerging markets also continues to outperform the U.S. and generated a +27% YTD return, driven by Chinese government stimulus and strong results from Chinese technology companies.

- S. large cap companies continued their strong performance in the third quarter. Value and growth stocks enjoyed strong returns and growth continued to lead the way both for the quarter and YTD. The tailwind of the AI infrastructure buildout continues to benefit the technology and growth parts of the market. After trailing by a wide margin earlier in the year, small cap stocks continued to rally this quarter as the market broadened out.

- The fixed income markets benefited from falling rates and a stable economic environment. Fixed income returns in the U.S. were again positive, with strong returns YTD. High yield bonds remained strong amid steady investor confidence. Global fixed income was flat for the quarter but remains up almost double digits.

A key overarching observation is that that no one asset class outperforms in every environment. It also highlights the importance of diversification – a central pillar of our investment strategy.

If you would like to discuss these asset class returns further, please reach out to your Callan Family Office team for additional information.

To download a PDF of the Callan LLC Periodic Table, please click here.

Callan Family Office (“CFO”) is providing the information from Callan LLC (“Callan”) for information purposes only. CFO is not involved in drafting or reviewing the content. Although we believe Callan and its content to be reliable, we make no representations as to their accuracy or completeness.

Callan Family Office (CFO) is the exclusive trademark licensee of Callan LLC. Callan LLC provides products and services to CFO. Clients of CFO are not clients of Callan LLC, and the parties are not affiliated. Callan LLC, CFO and the other Callan trademarks and service marks are registered and/or unregistered trademarks of Callan LLC and may not be used without its permission.

INVESTMENT ADVISORY SERVICES AND PRODUCTS PROVIDED TO CLIENTS OF CFO ARE PROVIDED SOLELY BY CFO AND NOT BY OR ON BEHALF OF CALLAN LLC. REPRESENTATIVES OF CFO ARE EMPLOYEES AND AGENTS OF CFO AND NOT EMPLOYEES OR AGENTS OF CALLAN LLC.

Callan Institute is affiliated with Callan LLC.