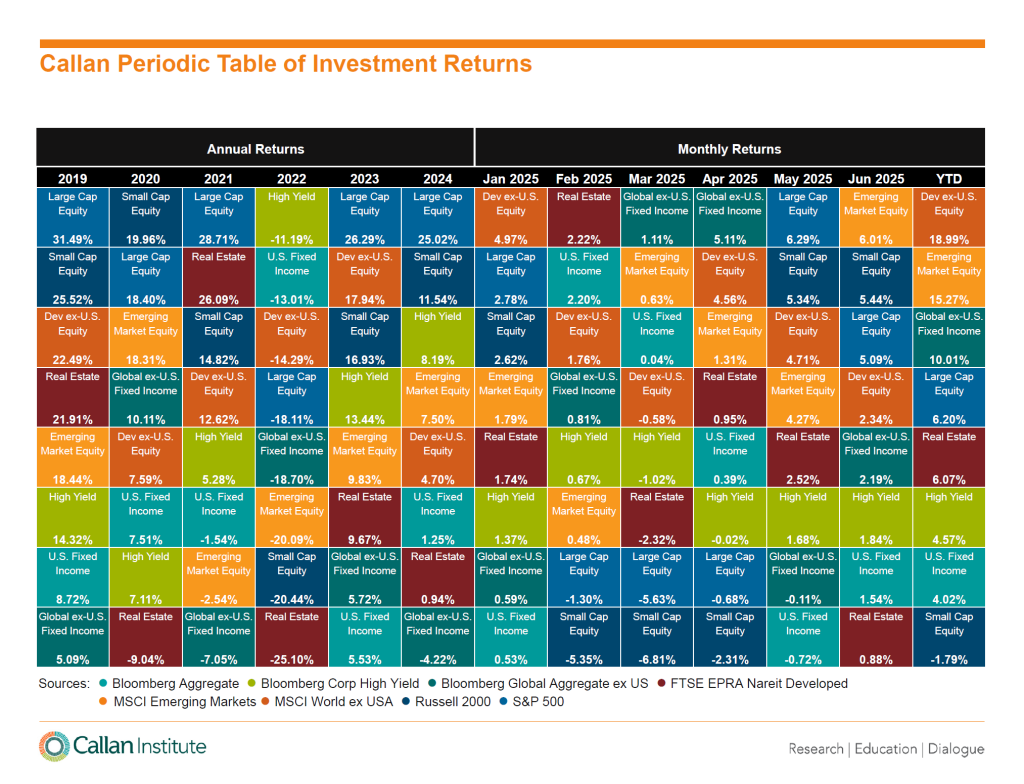

Please find attached The Callan Periodic Table of Investment Returns for the past five years ending December 2024 and through June 2025. This table visually represents the returns from most public asset classes available to investors, many of which are represented in Callan Family Office client portfolios. The returns are ranked annually from best (top of table) to worst (bottom).

This year’s returns illustrate strong performance from 2025 with positive results across most asset classes, even after domestic equities endured a correction earlier this year. International equities were the best performer fueled by several catalysts, including a weakening U.S. dollar.

A few observations worth noting:

- For the first six months of 2025, ninety percent of the listed asset classes generated a positive return. A notable exception was U.S. Small Caps as they fell 1.8%. The interest-rate-sensitive asset class faced headwinds in large part due to a more hawkish Federal Reserve.

- Developed International ex-U.S. and Emerging Market stocks are the market leaders this year, generating strong double-digit returns. Global fixed income also generated an unusually strong 10% return. The U.S. tariff policy, weaker U.S. dollar, and increased commitments to defense spending helped push these markets higher.

- Large Cap equities finished the first six months with a 6% return, fully recovering from the meaningful decline earlier this year. U.S. Growth led Value in the second quarter. This performance was driven in large part by the concentration of the Magnificent 7 stocks, which continue to benefit from artificial intelligence (AI) tailwinds.

- Core Fixed Income returns in the U.S. were up 4%, while High-Yield performed even better, up 4.6%. This occurred despite widespread expectations that the Federal Reserve would lower the Federal Funds rate this year, a move that has not yet materialized.

A key overarching observation is that that no one asset class outperforms in every environment. It also highlights the importance of diversification, a pillar of our investment strategy.

If you would like to discuss these asset class returns further, please reach out to your Callan Family Office team for additional information.

To download a PDF of the Callan LLC Periodic Table, please click here.

Callan Family Office (“CFO”) is providing the information from Callan LLC (“Callan”) for information purposes only. CFO is not involved in drafting or reviewing the content. Although we believe Callan and its content to be reliable, we make no representations as to their accuracy or completeness.

Callan Family Office (CFO) is the exclusive trademark licensee of Callan LLC. Callan LLC provides products and services to CFO. Clients of CFO are not clients of Callan LLC, and the parties are not affiliated. Callan LLC, CFO and the other Callan trademarks and service marks are registered and/or unregistered trademarks of Callan LLC and may not be used without its permission.

INVESTMENT ADVISORY SERVICES AND PRODUCTS PROVIDED TO CLIENTS OF CFO ARE PROVIDED SOLELY BY CFO AND NOT BY OR ON BEHALF OF CALLAN LLC. REPRESENTATIVES OF CFO ARE EMPLOYEES AND AGENTS OF CFO AND NOT EMPLOYEES OR AGENTS OF CALLAN LLC.

Callan Institute is affiliated with Callan LLC.