Business & Transaction Advisory

Selling a business is often the most transformative financial event of a lifetime—one with far-reaching implications for your family’s future and legacy. At Callan Family Office, we deliver seasoned, strategic consulting to help you navigate this pivotal moment with clarity, confidence, and control.

Our Business & Transaction Advisory practice is distinguished by a multi-disciplinary approach that integrates financial, tax, estate, legal, and M&A expertise—offering the comprehensive perspective required to align details of your planning with your long-term goals.

Our Services Include:

Capital Sufficiency Analysis

Assess the financial resources needed to sustain your lifestyle, support philanthropic goals, and secure multigenerational wealth after a liquidity event.

Integrated Wealth Planning

Build a cohesive plan that focuses on estate and gift tax efficiency, wealth preservation, and long-term growth tailored to your family’s unique vision and values.

Strategic tax planning

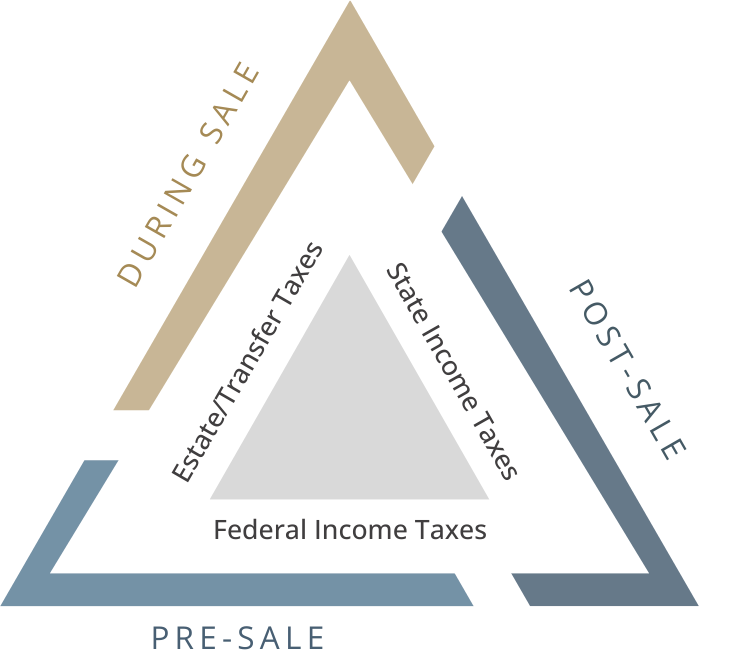

Model proactive strategies to minimize tax liabilities—federal, state, and estate—across the three phases of a transaction: before, during, and after the sale.

M&A Advisory Support

Offer clear, objective education on deal structures, tax implications, and transaction strategies, empowering you to make informed, confident decisions.

Advisor Alignment & Planning Cohesion

Coordinate and integrate planning with your legal and tax advisors to ensure alignment, streamline collaboration, and drive seamless execution of strategic advice.

Knowledge that Empowers

In addition to our advisory services, we offer a growing library of educational resources designed to help business owners make informed decisions. Whether you are a few years from an exit or actively preparing for a transaction, we are here to support you at every stage of the journey.

Mastering the "Tax Trilogy"

We provide strategic guidance on transaction structuring, integrating tax modeling, wealth transfer, and charitable planning to help minimize taxes and optimize outcomes for business owners and their families.

By addressing tax implications and opportunities at each stage of a transaction, we help clients preserve more of what they’ve built while aligning decisions with personal and legacy goals.

Educate:

- Gain a deeper understanding of what to expect at each stage of the transaction process.

- Identify common misconceptions and oversights that can limit flexibility or increase tax exposure.

- Demystify key legal and financial concepts in M&A.

Analyze:

- Assess financial readiness with capital sufficiency modeling to understand what you truly need from a sale.

- Evaluate key drivers of business value and how different transaction structures affect the outcome.

- Analyze tax exposure to minimize the three levels of tax during the three stages of a transaction (“Tax Trilogy”).

Advise:

- Leverage decades of transaction experience and tax expertise.

- Effectively allocate transaction proceeds across lifestyle, legacy and philanthropic objectives.

- Collaborate with your legal, tax, and transaction advisors to ensure alignment and seamless execution.

Contact Callan Family Office

To learn more about how we can best serve you, please reach out to our team.